How to freeze your credit with TransUnion

How to freeze your credit with TransUnion

A quick, piece of cake and free style to shrink your chances of identity theft is to freeze your credit. Once yous do, it'll be nearly impossible for someone else to open an account in your proper name, or even to see your credit file.

The downside is that yous won't be able to open a new account either. So each of the Large Three credit-reporting agencies — Equifax, Experian and TransUnion — makes it possible to temporarily (or permanently) "unfreeze" your credit for every bit long as you want.

- What to practise subsequently a data breach

- The best identity theft protection services

Thanks to a federal law that went into consequence in 2018, setting upwardly and managing credit freezes is free across the United states. But you still accept to set upwardly individual freezes at each credit agency, unlike fraud alerts with which you have to notify only one.

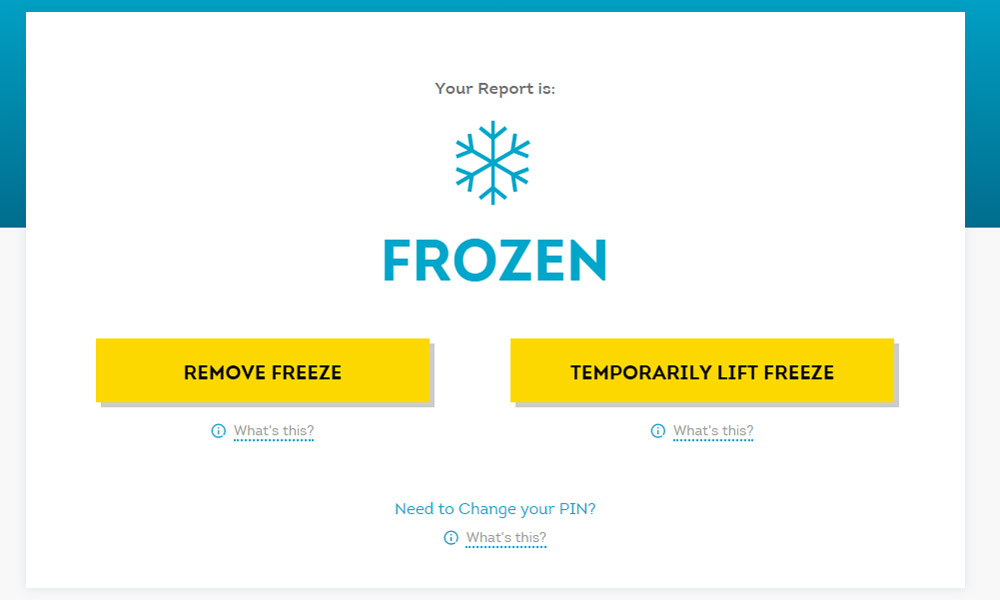

Like Equifax, TransUnion makes you lot create an account to prepare a credit freeze online, but the account is specifically for managing your credit files and is separate from TransUnion's identity-theft-protection service. You'll also accept to prepare a PIN for quick unfreezes.

TransUnion also offers something called a "Credit Lock," which is similar to a credit freeze but is subject to fewer government regulations. It gives you the advantage of "instant" locks and unlocks, whereas a modify to a credit freeze can take a couple of hours to get into effect. Depending on the features yous select, a Credit Lock may not be complimentary.

Below is how to gear up a TransUnion credit freeze. We too accept guides on how to asking an Equifax credit freeze and how to gear up an Experian credit freeze.

How to set a TransUnion credit freeze online

Get to https://www.transunion.com/credit-freeze and click "Add a freeze." You'll then need to set up an account: Enter your full name, address, electronic mail accost, phone number, appointment of birth and the last four digits of your Social Security number.

Submit that information, and TransUnion will so ask you some verification questions, such as where you lived the past and which companies yous've had accounts with.

Once that's done, y'all'll be asked to create a countersign for your account and a PIN to freeze and unfreeze your credit. Write those both downwardly.

How to ready a TransUnion credit freeze by telephone

To set a TransUnion credit freeze by telephone, call 888-909-8872. You lot'll exist asked for your name, accost, date of birth and Social Security number, and will take to respond identity-verification questions. You'll besides have to choose a PIN to unfreeze and freeze your credit.

How to prepare a TransUnion credit freeze past mail

Send a concern letter (via certified mail, if possible) containing your name, accost and Social Security number to:

TransUnion

P.O. Box 160

Woodlyn, PA 19094

TransUnion's website doesn't specify information technology, but you may desire to include with your letter photocopies of your commuter'southward license and recent utility bills or bank statements in your proper noun.

Source: https://www.tomsguide.com/how-to/how-to-freeze-credit-transunion

Posted by: nethertonwitesse.blogspot.com

0 Response to "How to freeze your credit with TransUnion"

Post a Comment